As of February 2025, the Canadian real estate market exhibits a mix feeling of resilience and caution. The Bank of Canada's recent decision to lower its benchmark interest rate by a quarter percentage point to 3% is anticipated to stimulate the market, encouraging more home buyers and potentially leading to increased transactions and modest price rises throughout 2025, therefore at this point in time, if you are considering jumping into the real estate market, now is the right time!.

Also the GTA real estate market is influenced by various factors:

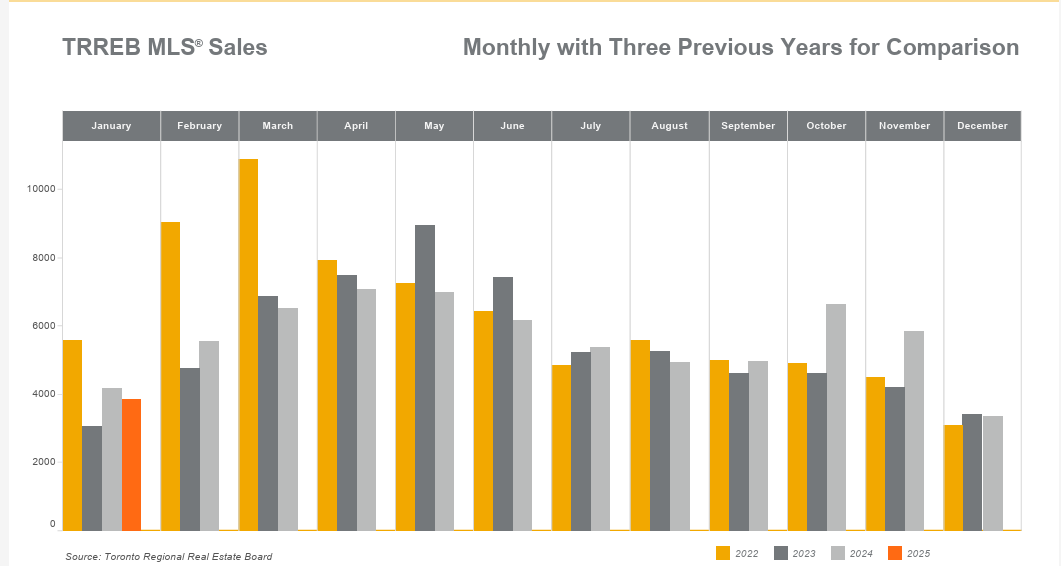

- Sales Activity: In January 2025, home sales in the GTA increased by 10% month-over-month to 5,971 units, following an 18.2% decline in December 2024. However, sales were down 10.7% compared to January 2024.

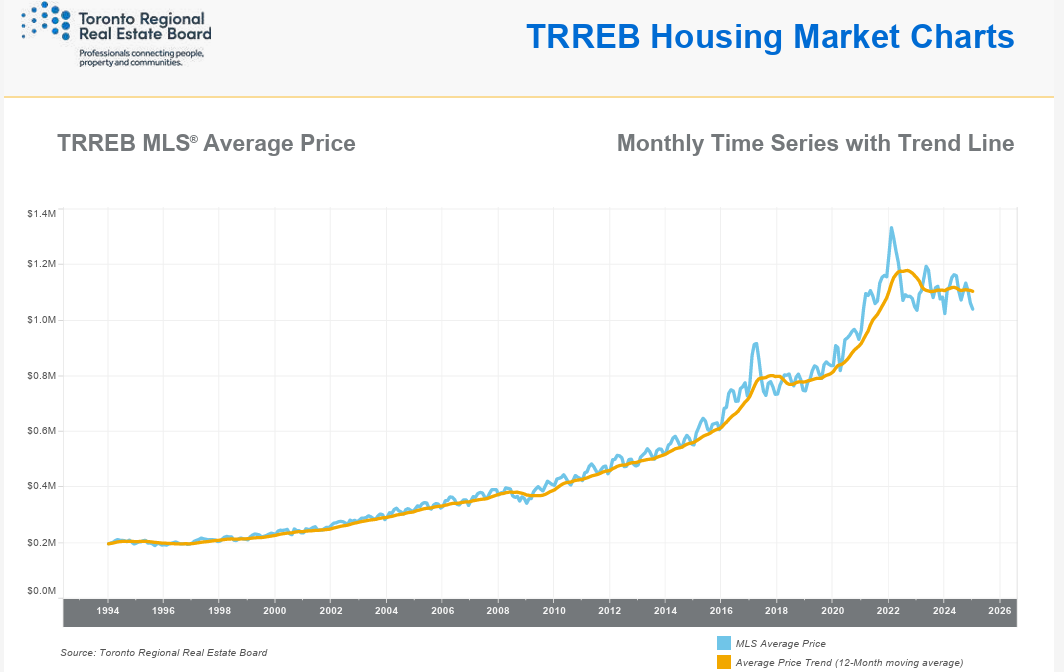

- Price Trends: The average home price in the GTA was $1,067,186 in December 2024, marking a 1.6% decrease year-over-year and a 3.5% decline month-over-month. The benchmark home price stood at $1,061,900, a 0.2% increase from the previous year, note the results vary from city to another , there is no definitive answer of what is more predominant in the market.

- Market Forecast: The Toronto Regional Real Estate Board (TRREB) anticipates a 12.4% rise in home sales and a 2.6% increase in the average selling price for 2025. Lower borrowing costs and ample housing supply are expected to improve affordability and encourage more buyers to enter the market.

- Interest Rates: The Bank of Canada recently reduced its benchmark interest rate by 0.25 percentage points to 3%, aiming to stimulate the economy. This move is expected to attract more home buyers, leading to increased transactions and modest price growth throughout 2025.

- Inventory Levels: New listings in the GTA surged by 26% in January 2025 compared to December 2024 and were up 48.6% year-over-year. This increase in supply may provide more options for buyers and help moderate price growth.

In summary, the GTA real estate market is poised for moderate growth in 2025, driven by lower borrowing costs and increased housing supply. While sales and prices are expected to rise, the market remains sensitive to economic conditions and consumer confidence.

In summary, while certain regions like the GTA are experiencing a rebound in sales, the broader Canadian housing market faces uncertainties due to economic and geopolitical shifts. The recent interest rate cut by the Bank of Canada may provide some stimulus, but factors such as reduced housing starts and adjusted immigration targets could influence market dynamics in the near future and for sure in the coming years.

My advice to you is to take advantage of the momentum in the market, stop paying someone else's mortgage and invest on your own property, for more information and assistance, don't hesitate to contact me through this channel, google page or social media, you could be closer to buy than you think.

Source reuters.com , trreb.ca

Post a comment