According to the latest news from the bank of Canada, they will hold the interest rate at five percent for the 6th consecutive time, the central bank says that inflation is still high, but everything is driving to the right direction.

While inflation index on January 2024 for Canada was around 3.1% and cooled off a bit for February 2024 to 2.8%, there is still a way to go. "The short answer is we are seeing what we need to see, but we need to see it for longer to be confident that progress toward price stability will be sustained. The further decline we've seen in core inflation is very recent. We need to be assured this is not just a temporary dip."

Bank of Canada Governor Tiff Macklem said that a rate cut in June is "within the realm of possibilities." If everything goes accordingly we could expect some changes by the middle of this year and more to come to 2025, with price growth slowing across goods, food, clothing and services, high rent and mortgage interest costs continue to drive up the overall inflation rate.

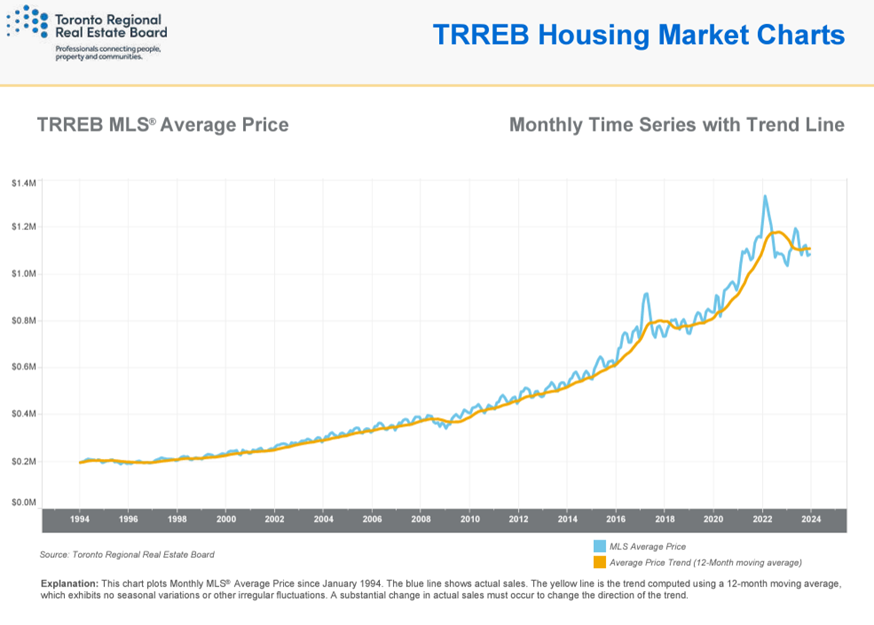

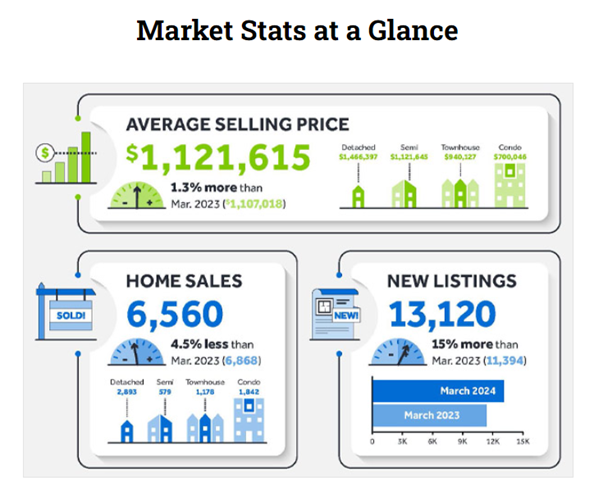

According to the latest march 2024 housing market update from Toronto Regional Real Estate Board (TREBB) the average price market has been consistently declining after 2022 and a sudden spike in 2023. The market demand is still very alive especially in the detached and semidetached segment, but affordability is playing an active role in slowing down the market overall.

As per march 2024 the home sales went down 4.5% compared to previous year, but there was a 15% increase of new listings, confirming the housing market is very much active but at a slower pace, have in mind the average price listed is broad number, if you would like to know specific prices, please feel free to reach me out and I will gladly dig deeper in numbers with you.

Have in mind that the housing market is always changing and changes are the only constant thing you will find across the statistics and time, but just like we did with the mortgage stress test, increased rates, etc. we will adapt and move forward, therefore if you are very actively trying to jump in to the real estate market, prepare yourself with enough knowledge and get in contact with a professional active real estate agent so that you get all the necessary tools to make your dreams come true.

Most of my clients when they reach out to me , they have an expectation but they never imagined how close they were to make their real estate dreams come true. Persist and conquer. Feel free to contact me through my different channels of Google, Instagram, Facebook, emails or directly through my websites.

Happy buying.

Post a comment